Lifting the Veil on Oil Company Payments and Their Impact on Developing Nations

Tutu Alicante’s personal experiences highlight the tragic consequences of inadequate healthcare in Equatorial Guinea despite economic growth from oil. The recent disclosures from American oil companies reveal substantial payments made to various governments, raising concerns about the equitable distribution of this wealth and the effectiveness of American tax policies compared to other countries. These disclosures prompt the need for further investigation into how resource wealth impacts lives and the potential for corruption in resource-rich nations.

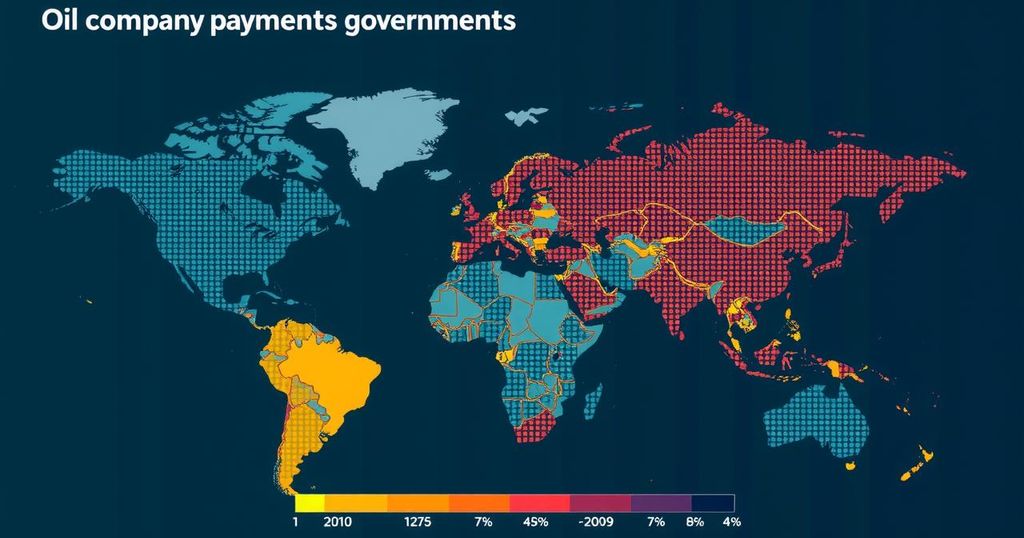

Tutu Alicante, the executive director of EG Justice, shared a poignant personal narrative during a recent webinar discussing oil company payments to governments. His sister succumbed to an ectopic pregnancy in an under-resourced hospital in Equatorial Guinea, a country that, since Mobil’s oil discovery offshore in 1995, has seen significant oil-driven economic growth. Yet, many citizens, including Alicante and his family, have experienced tragic consequences due to the lack of adequate healthcare. This disparity highlights the broader issue of wealth distribution within nations rich in natural resources. The webinar focused on newly released disclosures from American oil and mining firms to the U.S. Securities and Exchange Commission (SEC), which for the first time publicly details payments made to governments worldwide, including the United States. These reports reveal that in the last year, ExxonMobil, Chevron, and other companies cumulatively paid tens of billions of dollars in taxes, royalties, and other fees. While these payments are substantial, they raise critical questions about the effectiveness of resource wealth in improving citizens’ lives and combating corruption in countries like Equatorial Guinea. For instance, ExxonMobil paid $189.2 million to Equatorial Guinea, a fraction of its total global tax payments of $32 billion. Aubrey Menard from Oxfam America pointed out a concerning pattern: despite the U.S. being a major production site for Exxon and Chevron, the tax payments to the U.S. government were considerably lower than those in other countries. Exxon Mobil paid nearly five times more in taxes to the United Arab Emirates than in the United States, prompting discussions on the effectiveness of American tax policies in comparison to other nations. The webinar also highlighted the need for detailed disclosures that would assist communities and civil organizations in examining possible discrepancies between company reports and government accounts, thus revealing potential corruption. Although the SEC has provided some transparency, both advocates and companies face ongoing challenges in ensuring thorough accountability for these payments, particularly concerning state and local government taxes.

The recent disclosures from American oil and mining companies to the SEC stem from an amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, which mandated increased transparency in resource revenue. The reports serve to illuminate the financial dynamics between corporations and the governments of resource-rich nations, particularly in the context of corruption and economic disparity. These filings come after a prolonged effort to enact regulations that hold corporations accountable for their operations in various jurisdictions, emphasizing the critical need for equitable revenue distribution and the ramifications for societal welfare in countries reliant on extractive industries.

The release of these disclosures marks a significant step towards greater transparency regarding the financial dealings of oil and gas companies with governments. Such transparency can facilitate public discourse about the implications of these payments on community welfare and government accountability. Nonetheless, discrepancies in the amount owed to different countries prompt further investigation into taxation policies and economic agreements, indicating a need for reform that prioritizes the welfare of citizens over corporate profits. The overarching challenge remains in translating resource wealth into tangible benefits for the broader population, especially in nations where such wealth is concentrated amongst elites.

Original Source: insideclimatenews.org

Post Comment